About Us

Since 2002 CCSS - Credit Card Systems Services has been serving in the Credit Card Processing and Cash Advances solutions industry, we have contributed to the economic growth of a large number of merchants throughout all United States and Puerto Rico.

CUSTOMER SERVICE SUPPORT

At CCSS, customer service and support, is our main mission, for this reason we have a personalized customer service, and we attend to any request from our clients with favorable results in the shortest possible time. If you have already used our services, we invite you to share your opinion and leave us a review. We appreciate your opinion about our services.

PROCESSING

The credit card processing industry has different methods and ways of quoting the cost of its transactions. Below we present the different processing programs.

Call us at 866-364-2233 or write to Info@ccssusa.com to consult about the credit card processing according to your needs!

Tiered Basic

The tiered pricing structure, sometimes called bundle pricing, is a type of fee structure used by credit card processors. A tiered pricing structure typically has three tiers of transactions: qualified, medium-qualified, and non-qualified transactions, with each processor setting its own fees for each tier.

Flat Rate

Flat rate credit card processing is a set rate that business owners pay each month, regardless of the type of card or transaction method used. Flat rate pricing is designed to be simple and can be offered without a transaction fee, which can be beneficial for businesses with many transactions.

Pass Through I/C

Interchange pass through pricing is a form of credit card processing pricing that allows the actual cost of processing (interchange fees and assessments) to be passed directly to your business.

Cash Discount (Recommended)

A cash discount program is a type of credit card processing that passes the cost of acceptance back to customers who choose to pay with a credit card or debit card. Cash discount merchant services allow business owners to continue to accept all major credit cards, but without the loss of 3-4% in fees.

Note: The Durbin Amendment, included as part of the 2010 Dodd-Frank law, permits businesses to transfer all or a portion of their processing fees onto their customers. Thanks to the amendment, companies can now legally offer a discount to those who pay with cash or check instead of credit or debit card.

Enhanced Recover Reduction (ERR)

It is when the merchant has a qualified credit and debit flat rate plus surcharges on all downgraded fees. So, to calculate the costs for non-qual transactions, you need to add the qualified rate to the downgrade rate for the total. That is what ERR means.

Apply Now

FUNDING

Funding Requirement

Basically, to obtain an MCA, the merchant will have to demonstrate that his business is productive enough to cover the payback fees. The credit score in some cases would not be so necessary, but to the extent that the merchant's credit has a good credit score, this would help to obtain an MCA with softer or more favorable conditions.

Credit Score ranges and what they mean will vary based on the scoring model used to calculate them, but they are generally like the following:

300-579: Poor

580-669: Fair

670-739: Good

740-799: Very good

800-850: Excellent

ACH Loan

An ACH loan is short-term loan financing for companies lacking good or established business credit, not requiring collateral, with higher interest rates. ACH loans have strict recurring repayment terms through ACH (Automated Clearing House) withdrawals from the borrower's bank account by the lender.

Call us at 866-364-2233 or write to Info@ccssusa.comto consult about the ACH Loan according to your needs.

Split Funding Loan

It is a type of MCA that is generally collected via ACH or automatic withdrawal, based on an agreed percentage of daily generated bank deposits, which are considered gross sales.

Call us at 866-364-2233 or write to Info@ccssusa.com to consult about the Split Funding Loan according to your needs.

High-Risk Loans

They're called “high-risk loans” because they generally go to borrowers who don't have a solid track record of repaying debts, which could make default on the loan more likely. In many cases, these are unsecured loans, meaning they don't require the borrower to put up anything to use as collateral.

Call us at 866-364-2233 or write to Info@ccssusa.com to consult about the high-risk loans according to your needs.

Merchant Cash Advance - MCA

A merchant cash advance (MCA), sometimes called split financing, is a system in which a merchant sells for less, a specific amount of their projected future sales based on the history of credit cards processed at their business.

Call us at 866-364-2233 or write to Info@ccssusa.com to consult about the MCA according to your needs.

Real State Cash Advance

It refers to a type of MCA in which your business has been approved for an MCA and the amount approved is not enough for your project, but you have real estate that could serve as collateral for a larger amount, as long as the business would be able to pay the required fee.

Call us at 866-364-2233 or write to Info@ccssusa.com to consult about the Real State Cash Advance according to your needs.

Loan Terms

Loan terms refer to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged,

and any other special conditions that may apply.

Call us at 866-364-2233 or write to Info@ccssusa.com to consult about the Loan Terms according to your needs.

Apply Now

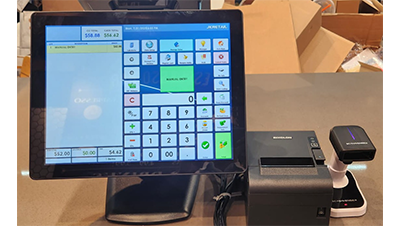

Merchant Services Point Of SaleS

Credit Cards Terminals

Credit Card Terminal is one of the most practical and simple solutions to process credit card transactions, at CCSS we offer credit card terminals completely free, plus free paper supply too, with an approved merchant account and actively processing with us.

Mobile Credit Cards Terminals

Portable Credit Card Machines [ No Internet connections necessary] Portable credit card terminals are the best solution for mobile businesses, such as fleet markets, food trucks and other similar mobile vendors.

POS SOFTWARE

A point-of-sale system (POS Software) is more than just a fancy cash register. POS Software Records sales, accepts payments, manages inventory, and analyzes sales data, to name just a few of its capabilities. It is an essential tool in trading for businesses of all sizes. POS Software is easy to use, making sales and inventory management a simple and straightforward process. At CCSS we have the ideal POS Software for your business or company, Restaurants, Supermarket, Grocery Stores, Liquors Stores .... Etc. Call us at 866-364-2233 or write to Info@ccssusa.com to consult about the POS Software according to your needs.

Recurring ACH Payments

What are recurring ACH payments? ACH (Automated Clearing House) When a natural person or commercial entity signs a contract, through which they assume to pay a specific amount of money on an exact date of the monthly calendar, which will be automatically withdrawn from the debtor's bank account until the total amount of the debt is charged in full. Call us at 866-364-2233 or write to Info@ccssusa.com to consult about the Recurring ACH Payments according to your needs. .

Virtual Terminal

A virtual terminal is a software application for merchants which allows them to accept credit cards payment, without requiring the physical presence of the credit card. in CCSS we can provide an option of virtual terminal completely free. Call us at 866-364-2233 or write to Info@ccssusa.com to consult about the Virtual Terminal according to your needs.

Payment Gateway

A payment gateway system is a technology used by merchants to accept debit or credit card transactions from their customers. A payment gateway system is ideal for online sales, also for sales of credit cards not present.

Apply now

Credit Card Processing “Merchant Services"

Merchant Cash Advance - MCA / Business Loan

SBA Loan

Real State Cash Advance

Personal Loan Application

Referral Partners

International Merchant Offshore

Authorize.net

PARTNERS

CCSS - Credit Card System Services

has alliances with the top leaders in the credit card processing industry and Merchant Cash Advances Funding Companies.

Apply Now

Priority Payment Systems

Merchant Services Low and Medium Risk

Priority Payment Systems LLC. Priority is a registered ISO of Wells Fargo Bank N.A., Walnut Creek, CA and a registered ISO/MSP of Synovus Bank, Columbus, GA. Priority Payment Systems is a participant in the American Express Opt Blue® program.

Maverick Payments

High-risk payment processing And ACH Solutions

Maverick™ is a division and registered trademark of Maverick Bankcard, Inc. Maverick is a registered ISO/MSP of Avidia Bank, Hudson, MA; Evolve Bank and Trust, Memphis, TN; Axiom Bank, N.A., Maitland, FL; Esquire Bank N.A., Jericho, NY; Mission Valley Bank, Sun Valley, CA.

Durango Merchant Services

International Merchant Services Account offshore Durango Merchant Services has been in the hard to acquire and international electronic payments industry for over 20 years.

Appy Now

Authorize.net

Payment Gateway And Virtual Terminal

Authorize.net, Is a payment gateway service provider, allowing merchants to accept credit card and electronic check payments through their website and over an Internet Protocol (IP) connection.

Founded in 1996 as Authorize.net, Inc., the company is now a subsidiary of Visa Inc. Its service permits customers to enter credit card and shipping information directly onto a web page, in contrast to some alternatives that require the customer to sign up for a payment service before performing a transaction.

Apply Now

Contact US

Mail us:

2441 WEBB AVENUE,

SUITE 11-F,

BRONX, NY 10468

Email:

info@ccssusa.com

Call Toll Free:

1 (866) 364-2233

FAX

(509) 463-8926

TEXT

(917) 655-8888